oregon tax payment deadline

Directors Order 20-01 extended the Oregon tax filing and payment deadline from April 15 2020 to July 15 2020. Kate Brown extended the states original tax deadline due to the coronavirus pandemic.

The dates at the.

. Oregonians who owe tax payments but cannot pay can work with the. Oregon recognizes a taxpayers federal extension. Cash payments must be made at our Salem headquarters located at.

Cookies are required to use this site. The Oregon income tax payment deadline for payments due with the 2019 tax year return is automatically extended to July 15 2020. Mark the Extension box when you file your Oregon individual income tax return.

With property taxes due on the following Nov. The Oregon Tax Payment System uses the ACH debit method to make an Electronic Funds Transfer EFT to the state of Oregon for combined payroll taxes or corporation excise and income taxes. Tax filing and payment due dates for individuals from April 15 2021 to May 17 2021.

Due Date Extension. Skip to the main content of the page. Find approved tax preparation services.

Oregon doesnt tax your military pay if you arent an Oregon resident. Form OR-40 OR. Oregon recognizes your federal extension.

Call at least 48 hours in advance 503 945-8050. Oregon Department of Revenue. Individual taxpayers can now postpone federal income tax payments for the 2020 tax year normally due on April 15 2021 to.

This automatic Oregon tax filing and payment deadlines extension incorporates some but not all of the elements of the federal income tax filing and payment deadlines extension. If you need assistance with the preparation of your return visit the Taxpayer Assistance page. Individual taxpayers who need additional time to file beyond the May 17 deadline can request a filing extension until October 15 by filing federal Form 4868 through their tax professional or tax software or by using the Free File link on IRSgov.

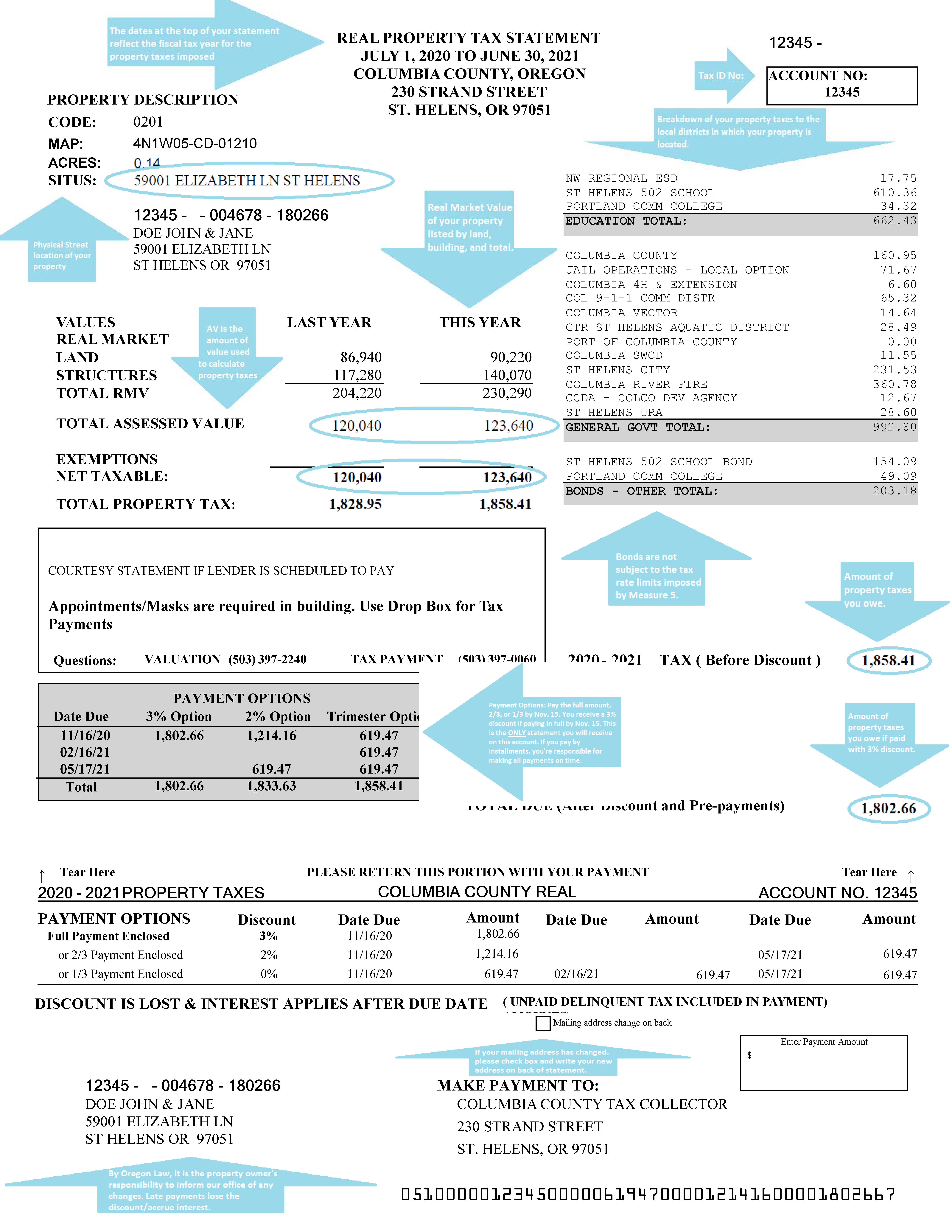

As a result interest and penalties with. As a service to our citizens payments can be made by credit card. Our fiscal tax year runs from July 1 through June 30.

Please see Form OR-65 Instructions for due dates for non-calendar-year filers. Your browser appears to have cookies disabled. Payments can be made by choosing the.

Oregon has joined the Internal Revenue Service IRS in postponing the tax filing and payment due dates for individuals from April 15 2021 to May 17 2021. Or make tax payments call. Estimated tax payments are still due April 15 2021.

Oregon Department of Revenue. A timely filed extension moves the federal tax filing deadline and the Oregon filing deadline to October 17 2022. If you requested a federal extension you DO NOT need to request an Oregon extension.

The time for making estimated tax payments for tax year 2020 is. Last date to file individual refund claims for tax year 2018. The 2021 tax deadline to file City of Oregon returns is April 18 2022.

The Oregon Department of Revenue announced late Wednesday March 25 2020 that the state of Oregon will officially extend the deadline for certain tax payments until July 15 2020. The Oregon Department of Revenue DOR intends to follow guidance from the IRS when more details become available. Instructions for personal income and business tax tax forms payment options and tax account look up.

Everything you need to file and pay your Oregon taxes. In Oregon property is valued as of Jan. If you have any questions or problems with this system please call our EFT HelpMessage Line at 503-947-2017 or visit our EFT Questions and Answers.

Mail check or money order with voucher to. For more information please visit our. Oregon offering tax relief due to pandemic wil dfires Federal relief The American Rescue Plan Act of 2021 ARPA is a 19 trillion federal COVID-19 relief bill including more direct payments to taxpayers an expansion of jobless benefits funding for state and local governments and an expansion of vaccinations and virus-testing programs.

What are the specific Oregon tax returns for which filing deadlines have been postponed to May 17 2021. Form OR-40 OR-40-N and OR-40-P Oregon Personal. If you performed active military service in 2021 and your Defense Finance and.

Free tax preparation services Learn more. Federal Tax Form 1040 KATU PORTLAND Ore. Your 2021 return is due October 17 2022.

An extension of time to file your return is not an extension of time to pay your tax. What are the specific Oregon tax returns for which filing deadlines have been extended to May 17 2021. This includes payment of your 2021 tax liability.

After the Internal Revenue Service extended the deadline for people to file their taxes this year from April 15 to May 17 the Oregon Department of. Oregon has not postponed the first-quarter income tax estimated tax payment due date for 2021. It also applies to tax-exempt organizations operating on a calendar-year basis that had a valid extension due to run out on November 16 2020.

An extension to file is not an extension to pay. The January 15 2021 deadline also applies to quarterly estimated income tax payments due on September 15 2020 and the quarterly payroll and excise tax returns normally due on November 2 2020. July 15 marks three months since Oregon Gov.

The Directors Order does postpone to May 17 2021 the expiration to file a claim for credit or refund of Oregon personal tax if the period would have expired on April 15 2021 for example. After much debate and pressure from a number of accounting professional groups the Internal Revenue Service recently announced that it is pushing back the individual tax filing and payment deadline from April 15 2021 to May 17 2021.

Oregon Reminds That Tax Filing Deadline Is April 18 News Kdrv Com

Ifta Fuel Tax Returns Global Multiservices Tax Return Global Renew

Accounts House Google Certified Accountant How To Plan Accounting

Financial Aid Overview For High School Seniors Infographic Scholarships For College Financial Aid For College Financial Aid

The Ftb Reminded Taxpayers That Thursday October 15 Is The Deadline For Filing 2019 State Personal Income T California Summer School Programs Penitentiary

Tax Payroll And Compliance Deadlines 2021 Christianson Pllp

![]()

Accounts House Google Certified Accountant How To Plan Accounting

Columbia County Oregon Official Website Understanding Your Property Tax Statement

Oregon Reminds That Tax Filing Deadline Is April 18 News Kdrv Com

Irp Plates Renewal The Duty Of Every Motor Carrier Renew How To Plan Plates

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

Key 2021 Dates For The Oregon Corporate Activity Tax Jones Roth Cpas Business Advisors

Where S My State Refund Track Your Refund In Every State Taxact Blog

Oregon Man Finds Year Old 1 Million Lotto Ticket Eight Days Before Deadline Bilet Fakty Mir

How To File Taxes For Free In 2022 Money

Get Truck Authorities And Permit Through Global Multi Services Global Trucks Trucking Business

When Are Taxes Due In 2022 Here Are All The Major Deadlines Money